Accounting is often described as the language of business, and understanding its fundamental processes is crucial for finance professionals. One of the foundational concepts in accounting is the seamless flow from journal entries to the ledger account. This flow is the backbone of accurate financial recording and reporting.

For financial analysts, accountants, and business managers, grasping how journal entries translate into ledger accounts is critical—not just for maintaining records, but for ensuring the integrity and transparency of financial data. This guide will walk you through the step-by-step process, unpacking each stage with precision and clarity.

What Are Journal Entries and Ledger Accounts?

Before delving into the flow process, it’s important to define these two fundamental components:

Journal Entries

- Journal entries are the initial records of financial transactions.

- They capture the “what,” “when,” and “where” of a transaction.

- Each entry follows the double-entry bookkeeping system—meaning every debit has a corresponding credit.

- Journal entries include the transaction date, accounts involved, amounts debited and credited, and a brief description or narration.

Ledger Accounts

- A ledger account is a collection of all transactions related to a specific account.

- It groups journal entries by account, showing cumulative debits and credits.

- The ledger forms the basis for trial balances and financial statements.

The Importance of the Flow from Journal to Ledger

Understanding how journal entries flow into ledger accounts is vital because:

- It ensures accuracy by organizing raw transaction data into meaningful account summaries.

- It provides an audit trail allowing transactions to be traced back to source documents.

- It supports financial analysis by categorizing data into specific accounts for review.

- It facilitates compliance with accounting standards and regulations.

Step 1: Recording Transactions as Journal Entries

The journey begins with identifying and recording transactions.

Key Elements of Journal Entries:

- Date: When the transaction occurred.

- Accounts Affected: Typically, at least two accounts involved due to double-entry accounting.

- Debit and Credit Amounts: Quantify the impact on accounts.

- Narration: Explains the nature or purpose of the transaction.

Example:

A company purchases office supplies worth $1,000 in cash.

- Debit: Office Supplies Account $1,000

- Credit: Cash Account $1,000

The journal entry records this event in a chronological journal book.

Step 2: Posting Journal Entries to the Ledger Account

Once journal entries are recorded, the next critical step is posting these entries into corresponding ledger accounts.

What Does Posting Mean?

- Posting is the process of transferring debit and credit amounts from the journal to the ledger accounts.

- Each account affected by the transaction gets updated with the corresponding debit or credit entry.

- This step organizes the scattered journal entries by account, making it easier to analyze and summarize financial data.

How Posting Works:

- Identify the accounts involved in the journal entry.

- Enter the debit amount in the debit column of the respective ledger account.

- Enter the credit amount in the credit column of the respective ledger account.

- Update the running balance after each posting to maintain current account status.

Step 3: Understanding the Ledger Account Format During Posting

Financial professionals must be familiar with the ledger account format as it guides accurate posting.

Typical Ledger Account Format Includes:

- Account Title: The name of the specific ledger account (e.g., “Cash,” “Accounts Payable”).

- Date Column: When the transaction is posted.

- Description/Particulars: A brief note referencing the journal entry or transaction.

- Reference Number: Cross-reference to the journal entry or source document.

- Debit and Credit Columns: Recording the amounts as per journal entries.

- Balance Column: Shows the updated balance after posting each transaction.

Step 4: Balancing the Ledger Account

As postings accumulate, maintaining the accuracy of the ledger account balance is essential.

How to Balance a Ledger Account:

- Start with the opening balance (if any).

- Add debit entries to the debit side.

- Add credit entries to the credit side.

- Calculate the net balance by subtracting total credits from total debits (or vice versa depending on account type).

- Record the balance on the side that has the greater total, showing either a debit or credit balance.

Why Balancing Matters:

- It ensures the ledger accounts reflect the true financial position.

- It aids in preparing trial balances and financial statements.

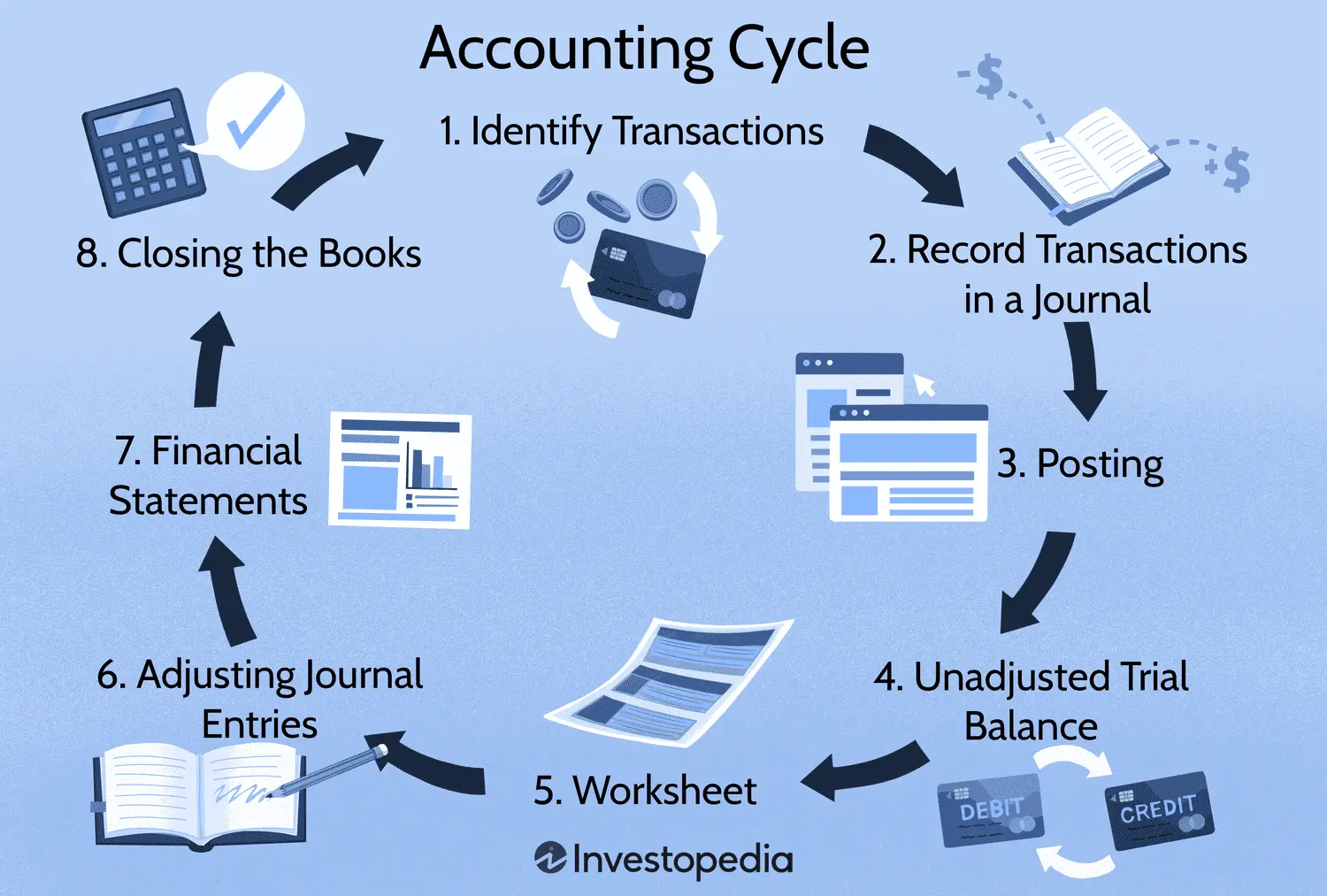

- It helps detect errors early in the accounting cycle.

Step 5: Preparing the Trial Balance

After all journal entries have been posted and ledger accounts balanced, the next step is preparing a trial balance.

What is a Trial Balance?

- A trial balance is a summary of all ledger account balances.

- It verifies that total debits equal total credits.

- Any discrepancies indicate errors that require investigation.

The Trial Balance Links Journals and Ledgers

- The accuracy of journal entries and posting to ledger accounts directly impacts the trial balance.

- Analysts use the trial balance as the starting point for adjusting entries and final financial reporting.

Common Challenges in the Journal-to-Ledger Process

Though straightforward in theory, several challenges can complicate the flow from journal entries to ledger accounts:

- Errors in Journal Entries: Incorrect amounts, wrong accounts, or missed entries lead to inaccurate ledgers.

- Posting Errors: Posting to incorrect ledger accounts or reversing debit and credit amounts.

- Timing Differences: Delays in posting may disrupt real-time financial analysis.

- Volume of Transactions: Large volumes increase the risk of data entry mistakes.

- Lack of Proper Documentation: Missing source documents can cause difficulties during audits.

Best Practices to Ensure Accurate Flow from Journal Entries to Ledger Accounts

To maintain the integrity of financial data, organizations should adopt best practices:

- Use Accounting Software: Automation reduces manual errors and speeds up posting.

- Implement Review Procedures: Regular audits and reconciliations help detect discrepancies early.

- Standardize Narrations: Clear and consistent transaction descriptions improve traceability.

- Train Staff Thoroughly: Skilled accounting personnel minimize data entry mistakes.

- Maintain Proper Documentation: Keep source documents organized and accessible.

Role of Technology in Streamlining Journal-to-Ledger Flow

Modern accounting systems have transformed the traditional journal-to-ledger process:

- Automated Posting: Systems automatically post journal entries to ledger accounts in real time.

- Real-Time Ledger Balances: Instant updates improve decision-making accuracy.

- Integrated Systems: Enterprise Resource Planning (ERP) platforms integrate journals, ledgers, and financial reporting.

- Error Detection Tools: Built-in validation reduces posting errors and flags inconsistencies.

Conclusion

Understanding how journal entries flow into ledger accounts is fundamental for ensuring accuracy, transparency, and compliance in financial management. This process forms the foundation upon which all financial reporting and analysis are built.

By mastering each step—from recording journal entries, posting to ledger accounts, balancing ledgers, and preparing trial balances—financial professionals can safeguard data integrity and provide actionable insights.

As businesses evolve and transaction volumes increase, leveraging technology to automate and validate these processes becomes essential. Ultimately, a clear grasp of this accounting flow empowers financial analysts and accountants alike to maintain robust financial records and support strategic decision-making with confidence.

Also Read-Selecting the Right Tech Stack for Mobile App Success