Introduction

Losing a loved one is always tricky, and the legal complexities that follow can deepen the strain, especially if the person passed away without indicating their wishes in a will. Asset distribution is determined by a state’s intestacy laws when this occurs. In California and across the U.S., these laws define who will inherit the deceased’s property and in what proportions. For a comprehensive overview of specific rules and inheritance order, the California intestate succession framework explains who can inherit without a will, providing clarity for families navigating this uncertain territory.

Intestate succession isn’t just a legal formality—it’s a process that could lead to results that the deceased never intended. Assets are distributed according to a strict hierarchy of relatives as set forth by state law, regardless of actual relationship closeness or the intentions of the deceased. This means cherished friends, unmarried partners, or stepchildren may be left out, while distant relatives could inherit unexpectedly.

Because these laws are state-specific, it’s essential for anyone living in California—or anywhere else—to understand the nuances that might affect their family situation and legacy. People often assume that their assets will go to their immediate family if they pass away without a will, but the reality is more complex. In some instances, assets could end up with people they barely knew, or even revert to the state if there are no legal heirs.

Understanding Intestate Succession

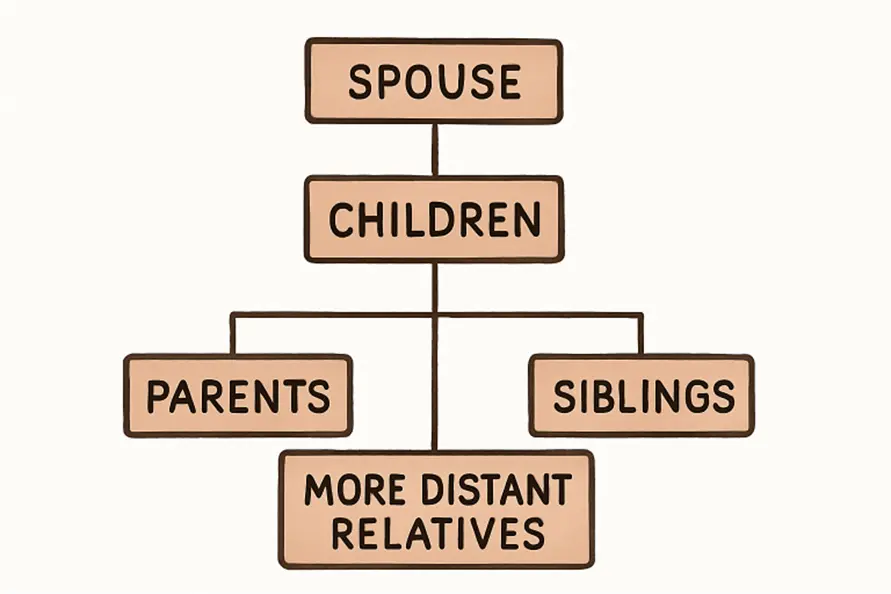

Intestate succession is the legal process enacted when someone dies “intestate,” or without a valid will. This process relies on a predetermined order of inheritance to divide assets. Typically, a surviving spouse and children will be the primary heirs. Still, if these do not exist, the law moves further down the family line—next to parents, then siblings, and potentially onward to grandparents or more distant relatives.

State-Specific Variations

While the underlying principles of fairness and kinship guide intestate succession across all states, the details can differ dramatically based on local statutes. For example, California claws back assets for the government (a process called “escheat”) if there are no qualified relatives. This structure may dictate the specific shares inherited by stepchildren, half-siblings, or adopted children, making it critical to understand precisely how your personal situation could play out under your state’s rules.

Assets That Bypass Intestate Succession

Not all property is governed by intestate succession. Certain assets transfer directly outside probate, regardless of state inheritance laws. These include:

- Property owned in joint tenancy or community property with right of survivorship, which passes directly to the surviving owner

- Life insurance proceeds and retirement accounts with up-to-date named beneficiaries

- Bank or investment accounts titled “payable on death”

- Assets in a living trust

By properly designating beneficiaries or co-owners, you can ensure that these assets reach their intended recipients swiftly and outside the probate process.

The Role of Probate in Intestate Estates

Probate is the court-supervised process of validating an estate, paying remaining debts, and distributing assets according to the law. When no will exists, the court appoints an administrator—often a close relative—to oversee these tasks. The administrator’s responsibilities include:

- Assembling and appraising the deceased’s assets

- Settling outstanding debts and tax obligations

- Allocating the remaining property according to state intestacy laws

Because the process may involve multiple heirs and potential disputes, probate can last several months to over a year and may incur significant legal fees.

Challenges and Complications

Dying without a will can strain even close families, as state law offers little flexibility for unique family circumstances or interpersonal wishes. Common problems include:

- Heated disputes among family members over fair asset distribution

- Lengthy court proceedings that delay closure and access to assets

- Unintended beneficiaries, such as estranged relatives or, in rare cases, the state itself

These issues may worsen if assets are complex, families are blended, or loved ones have special needs that ordinary inheritance laws overlook.

Preventing Intestate Succession

Effective estate planning can prevent the complications of intestacy and provide peace of mind that your assets will be distributed as you desire. Essential steps include:

- Create a Will: Specify who should inherit your property and appoint a trusted executor to handle your estate.

- Establish a Trust: A revocable living trust can bypass probate entirely and give greater privacy and control over asset allocation.

- Update Beneficiary Designations: Regularly review and update beneficiary forms on insurance policies, retirement plans, and investment accounts.

- Consult a Qualified Attorney: Estate planning attorneys can explain the intricacies of your state’s laws and guide you in crafting a comprehensive plan tailored to your family’s needs.

Conclusion

Understanding how an estate is distributed without a will highlights the crucial need for proactive legal planning. When someone passes away intestate—without a valid will—state laws take over, determining how assets are divided among surviving relatives. This often leads to unintended outcomes, such as distant family members receiving property while close friends or partners are left out entirely. Without your guidance, the probate process becomes longer, more complex, and emotionally draining for those left behind. Establishing a clear estate plan, including a legally binding will, trusts, and updated beneficiary designations, allows you to control where your assets go and how your legacy is preserved. Taking time to plan ensures your loved ones are cared for, avoids unnecessary legal hurdles, and helps minimize potential disputes. Thoughtful estate planning also brings peace of mind, knowing your wishes will be respected. In today’s world, securing your family’s future begins with the simple but powerful act of planning.

Also Read-Top Data Science Tools Powering Modern Fintech Solutions