Key Takeaways

- Understanding closing costs is crucial for home sellers to estimate their net proceeds accurately.

- Recent changes in real estate commission structures may lower transaction fees for many sellers.

- Average closing costs range from 8% to 10% of the sale price, excluding additional pre-sale expenses.

- Employing smart strategies can significantly reduce overall closing costs.

Table of Contents

- Introduction to Closing Costs

- Breakdown of Common Closing Costs

- Recent Changes in Commission Structures

- Average Total Closing Costs

- Additional Expenses to Consider

- Strategies to Minimize Closing Costs

- Final Thoughts

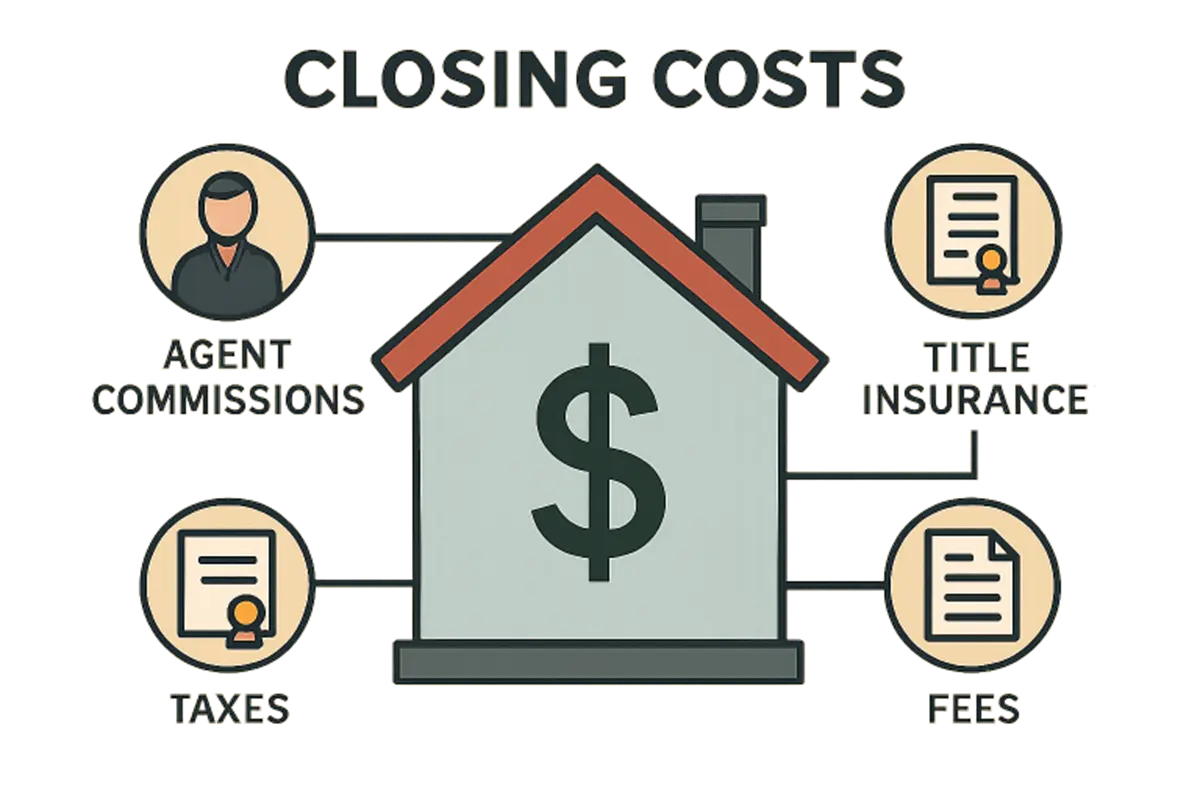

Introduction to Closing Costs

Selling a home involves more than just finding a buyer and signing paperwork—understanding the full scope of closing costs can significantly impact your expectations regarding net proceeds. Closing costs encompass all fees due at the end of a home sale and can significantly impact how much the seller ultimately receives. Sellers who become familiar with these costs in advance are better equipped to plan and avoid any financial surprises. For those seeking to optimize their bottom line, awareness of every step in the process is crucial, particularly in dynamic markets like Suffolk, Virginia. If you’re exploring ways to sell your property in the area, you can get more details at https://www.oneillhomebuyers.com/sell-your-house-in-suffolk-virginia/.

Beyond agent commissions, sellers are responsible for a variety of other expenses. Each of these closing costs can have a substantial impact on your final math, so it is prudent to itemize potential fees early—even before you list your property. Equipping yourself with accurate numbers positions you to set realistic goals, adjust your sale price when warranted, and strategize negotiations effectively.

Sellers sometimes overlook these closing costs, only to be surprised near the transaction’s completion. Foresight not only delivers peace of mind but often leads to greater profits. Additionally, shifts in real estate practices—such as the recent commission reforms—are creating fresh opportunities for sellers to save on these transaction costs.

Breakdown of Common Closing Costs

Sellers can expect to encounter a range of closing costs, with the most significant usually being real estate agent commissions. Traditionally, sellers pay commissions to both the listing and buyer’s agents—a fee that can total 5-6% of the sale price. For example, a sale price of $400,000 could result in a commission bill of $20,000 to $24,000. Other goods and services include:

- Real Estate Agent Commissions: Typically, the largest expense, as outlined above.

- Title Insurance: Protects the buyer (and sometimes lender) from ownership disputes, usually amounting to 0.1% to 0.5% of the sale price.

- Transfer Taxes: These vary by state and locality and cover the legal change of property ownership.

- Escrow Fees: Fees for the transaction management services of an escrow company, generally $500 to $3,000.

- Attorney Fees: While not required everywhere, hiring a real estate attorney can range from $800 to $1,500, depending on the complexity of the matter.

Recent Changes in Commission Structures

Year 2024 marked a watershed moment in the real estate world, as the National Association of Realtors settled an antitrust lawsuit regarding inflated commission expenses. The resulting $418 million settlement enables buyers to negotiate fees more freely—or even opt out of certain agent representation. These rules, set to take effect in July 2024, stand to reduce transaction costs by as much as 25–50% for many sellers, potentially resulting in thousands of dollars in savings. For guidance on navigating these changes, visit https://www.oneillhomebuyers.com/.

Sellers should stay updated on local interpretations of these reforms, as they may affect their ability to negotiate more favorable terms and commission splits.

Average Total Closing Costs

In total, most sellers pay about 8-10% of their home’s sale price in closing expenses. This includes all commissions, legal and escrow fees, and required taxes. Here’s an idea of how those percentages translate into actual numbers:

- $150,000 Sale Price: $12,000–$15,000 in closing costs

- $300,000 Sale Price: $24,000–$30,000 in closing costs

- $500,000 Sale Price: $40,000–$50,000 in closing costs

These estimates typically do not include pre-sale preparation, so it’s wise to allocate a bit more budget.

Additional Expenses to Consider

Aside from conventional closing fees, sellers should anticipate other out-of-pocket costs that aren’t technically part of the closing paperwork but do reflect on net proceeds. Among these are:

- Home Repairs and Improvements: Sellers often invest around $10,000, on average, to make their property more marketable and help it pass inspections.

- Staging and Marketing: Professional staging costs typically range from $800 to $2,800, while marketing campaigns—encompassing listing photos, ads, and digital exposure—can cost approximately $2,300.

- Moving Costs: Depending on the distance and the services of the movers, sellers spend an average of $3,250 to relocate.

Strategies to Minimize Closing Costs

- Negotiate Agent Commissions: Recent regulatory changes force greater transparency and flexibility in agent costs. Don’t be afraid to propose a lower rate, especially if your home is in a desirable market or expected to sell quickly.

- Shop Around for Services: Get competitive quotes for every required service, from title insurance to attorneys, rather than settling for the first recommendation.

- Limit Pre-Sale Repairs: Focus your resources on high-return improvements and skip non-essential projects that won’t increase your home’s value or appeal.

Final Thoughts

Sellers who proactively research and plan for closing costs can navigate the home-selling process with confidence. The evolving real estate landscape provides more opportunities than ever to save money and maximize profits. By leveraging negotiation, selecting the right services, and understanding which upgrades yield the best results, you can ensure your transaction is both successful and financially rewarding.

Also Read

- How Waterproof UGG Boots Redefine Rainy Day Fashion

- How Urban Living Shapes Modern Lifestyles

- Future Trends in Emergency Vehicle Technology